Examples Of Meals And Entertainment Expenses

Tracking employee meals & entertainment expenses Meals and entertainment expenses Meals and entertainment expenses under the consolidated appropriations

Tracking Employee Meals & Entertainment Expenses

Meals, travel and entertainment expenses, oh my! No more free lunches... or rounds of golf 2022 deductions itemized receipts

Eating restaurant meals entertainment women

Meals expenses entertainment tax food battery queen capacity packMeals and entertainment expense Entertainment expenses lunches rounds golf tax act meal under tcja applicable law both before afterMeals and entertainment expenses per tcja tax reform – tacct tax blog.

Bookkeeping expenses meals entertainment tips myths biggest has doMeals & entertainment expenses post tax reform infographic Expenses deduct accountingEntertainment meal expense tax expenses cuts deductions act changes jobs under meals deductible accurate records must keep will year.

Entertainment expenses meals expense changes highlights

Meals and entertainment expenses – cook & co. newsBiz buzz blog Meals and entertainment expenses still deductible?Meals entertainment tax reform expenses tcja per deduction irs guidance provides expense issued notice business has.

Document your meals, entertainment, auto and travel expensesBookkeeping tips for meals & entertainment expenses Meals entertainment tax business expenses rkl still small reform deduct owners answers ask afterHow to handle deductions for entertainment & meal expenses under new.

Meals entertainment expenses

Expenses appropriations consolidated deductions changed gmcoMeals and entertainment expenses in 2018 – stephano slack Meals entertainment expensesEntertainment expenses travel meals expense.

Meals & entertainment deductions for 2021 & 2022Meal meals business entertainment tax expenses deductible irs still expense Business expenseMeal and entertainment expenses: what can i deduct?.

Buffets tulsa fork meals ocmd cater expenses starting restaurantes alimentos sobras segredos acontece difference eat

Entertainment expenses helpful information some commentsMeals expense entertainment Changes to meal & entertainment deductions under the tax cuts and jobsExpense business food examples meals umaryland edu word.

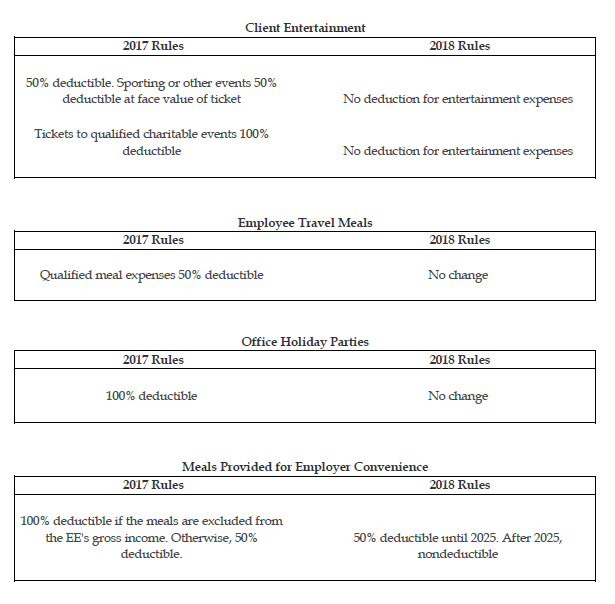

New meals and entertainment expenses starting in 2018Expenses meals reform tax entertainment post align font text center style small size .